News

The Rise of the ‘Invisible Customer’ in EU E-Commerce: Rethinking Customer Relationship Strategies Amidst Regulatory Pressures

17/10/2025

Despite the hurdles of varying market conditions and logistical complexities, the story of e-commerce within the EU over the past decade has been one of remarkable expansion. What began as a growing alternative to traditional retail has steadily transitioned into a dominant force, with both the number of online shoppers and the value of e-sales rising sharply. The European Parliament has as well recognised this shift, noting the increasing confidence of EU consumers in making purchases online. Consequently, this growing trust has opened doors for new entrants from beyond Europe’s borders and allowed established businesses to reach customers far beyond their traditional markets, reshaping the competitive and operational landscape of commerce across the region.

Key Highlights

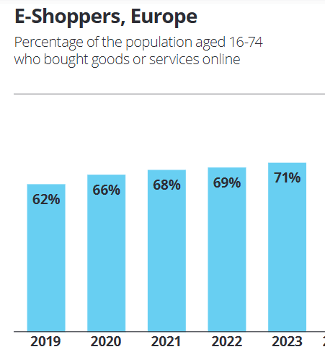

Key highlights have been the modest yet noteworthy 3% growth recorded in 2023 – in total B2C European e-commerce turnover – rising from €864 billion to €887 billion. In addition, an analysis covering 38 EU countries by Ecommerce Europe – a leading association representing the interests of companies selling goods and services online to consumers across the continent – further indicates a steady upward trend in the proportion of the population aged 16–74 making online purchases, with the current figure standing at 71% as of 2023.

Figure 1

Share of E-Shoppers Aged 16–74 in the EU

A Trend Overview: Adopted from ECommerce Europe. (2024). European E-Commerce Report 2024.

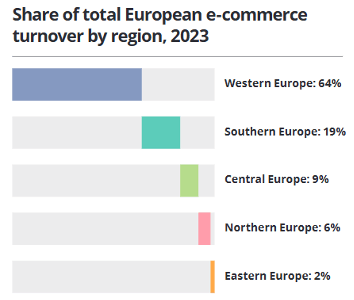

The report further highlights that Western Europe – most notably the United Kingdom, Germany, and France—remains at the forefront of B2C e-commerce turnover. Southern Europe – with Italy and Spain as key players – follows closely, even though it accounts for a comparatively smaller proportion of e-shoppers than Northern Europe, led primarily by Denmark, Estonia, and Finland among others, and Central Europe, where Austria, Czechia, Hungary, and Poland among others hold a dominant position.

Figure 2

Proportion of Total E-Commerce Contributions by Region in Europe

Adopted from ECommerce Europe. (2024). European E-Commerce Report 2024.

Customer Relationship Management: A Strategic Driver of This Success

And if research findings are anything to go by, substantial evidence points to a clear link – whether direct, moderating, or mediating – between the foundations of sustaining competitive advantage and a firm’s ability to leverage relationships with its customers. The underlying premise is that customers are viewed as strategic assets, managed through customer relationship management (CRM) practices. In this light, the notable statistics highlighted earlier can be firmly associated with the relational strategies adopted by the aforementioned firms, particularly their commitment to learning from customers and managing those relationships to generate long-term value.

No industry illustrates the importance of customer relationship management more clearly than luxury brands, which increasingly focus on cultivating close connections with consumers who seek personalised services and exclusive products. Isabel Gutierrez, CRM Manager at L’Oréal Luxe, underscores this by highlighting the value of investing in robust data infrastructures and tailoring databases to reflect local purchasing behaviours for targeted marketing. Such consumer-centric use of data enables the delivery of enhanced customer experiences across both physical and digital stores, particularly through personalised offerings and ultimately becoming a significant growth driver for luxury beauty brands.

Intensifying Regulatory Pressures in the EU

This stands out as a critical insight, emphasising that any factor capable of destabilising customer relationships may directly undermine business success and lead to a decline in firm performance. One of the most significant destabilising forces in recent years has been the intensifying wave of regulatory pressures across the EU. While these measures are designed to safeguard consumer rights, promote fair competition, and/or ensure data protection, they also introduce complexities that can challenge how firms manage customer relationships and sustain growth. It is within this evolving regulatory landscape that the future of e-commerce in the EU must now be considered.

Take for instance, EU’s recent move to remove duty-free exemptions on low-value imports, a change that follows a sharp surge in such shipments, with an estimated 4.6 billion parcels valued under €150 entering the EU in 2024 alone – roughly double the figure of the previous year and triple the year before. Roughly 91% of these imports originated from non-EU member states, raising concerns about consumer safety, fair competition, and environmental impact. In response, the EU proposed not only eliminating the exemption but also introducing a handling fee to cover supervisory and compliance costs.

While on one hand, this presents opportunities, including stronger oversight to safeguard consumer rights and ensure a level playing field, on the other hand, many local businesses point to the challenge of rising costs, particularly those associated with implementing such stringent regulatory measures. Consequently, this can place considerable strain on the trust that consumers have in e-commerce platforms, particularly when price increases are transferred directly to them without transparent justification. Such perceptions often erode customer loyalty and heighten the risk of consumers turning to competitors who are viewed as offering more affordable alternatives.

In navigating such challenges, it becomes essential for firms to look beyond compliance and develop the capability to sustain robust and trust-based relationships across their value chains, particularly within e-commerce, where consumer perceptions are highly sensitive to price and transparency. This is where Advance Operations Management School, Premier ELITE Partner of ASCM, The Association for Supply Chain Management, contributes meaningfully through its recognised APICS programmes. The CSCP course incorporates a distinct module on supply chain relationships, addressing both customer and supplier perspectives, while the CPIM programme extends this knowledge by engaging with areas such as Sales and Operations Planning (S&OP), which involves balancing aggregate demand and supply and reconciling S&OP plans. For e-commerce platforms navigating regulatory pressures, these courses equip practitioners with the insights and tools needed to not only meet compliance requirements but also transform them into opportunities for stronger consumer trust, more loyal customer bases, and resilient supply chain performance.

Courses linked

-

Master APICS CSCP - Certified Supply Chain Professional - Interactive Live Webinar

The Executive Master CSCP Interactive live webinar is designed to prepare the candidate for the Certified Supply Chain Professional certification (CSCP) of APICS, in the Supply Chain Management area. » -

Master APICS CTSC - Certified in Transformation for Supply Chain

This programme is designed to prepare candidates for APICS CTSC international certification (Certified in Transformation for Supply Chain) » -

Master APICS CPIM - Certified in Planning & Inventory Management - Interactive Live Webinar

The APICS Executive Master Interactive live webinar is designed to prepare the candidate for the international Certification in Planning & Inventory Management (CPIM) of ASCM, the Association for Supply Chain Management. » -

Master APICS CSCP - Certified Supply Chain Professional

Executive Master designed to prepare the candidate for the Certified Supply Chain Professional certification (CSCP) of APICS, in the Supply Chain Management area. » -

Master APICS CPIM - Certified in Planning & Inventory Management

The APICS Executive Master is designed to prepare the candidate for the international Certification in Planning & Inventory Management (CPIM) of ASCM, the Association for Supply Chain Management. »